Acorn Shariah-Compliant Portfolio

As Acorn Property Invest grows and innovates, we continually look to find ways of meeting investors’ returns objectives. We’re delighted to announce the launch of our latest offering, a unique way for halal investors to access the vibrant UK property market. Acorn Shariah-Compliant Portfolio offers halal investors quarterly or capital growth through our secure online platform.

The opportunity

Against a backdrop of economic uncertainty, property has, time and again proved to be a highly resilient asset class. In recent years, online platforms have opened up the market to a wider audience. Now, investors who would like to benefit from the vibrant UK property market in a way that conforms to Shariah investment principles can do so through our Acorn Shariah-Compliant Portfolio.

Acorn has been at the forefront of sustainable design and build practices since we installed our first ground source heat pump in 2007. With sustainability high on everyone’s agenda and housebuilders facing tough new regulations, the need for improved design and construction methods has never been greater.

Project updates

Planning Granted at Ashton Fields

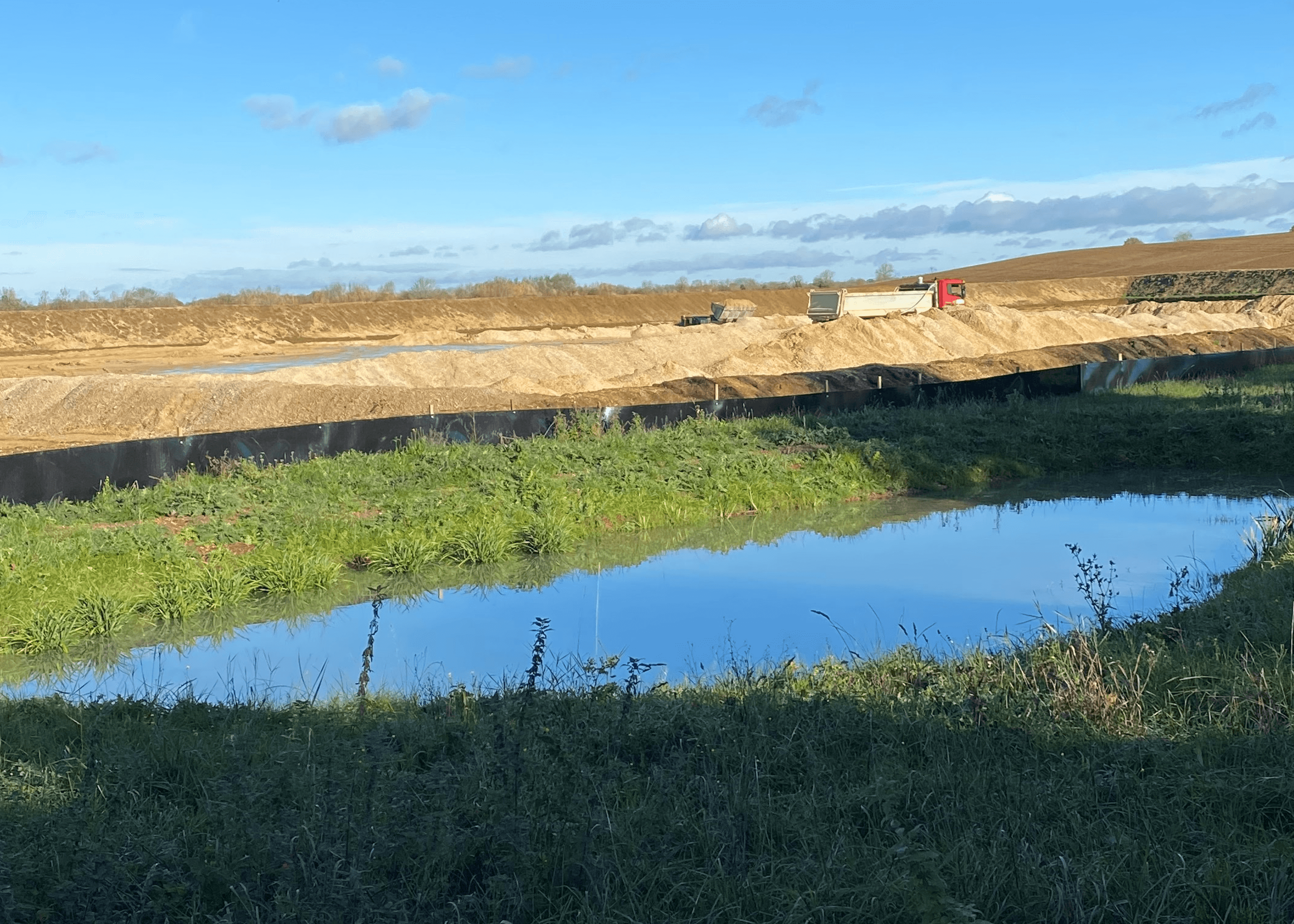

After a long and complex journey, we are pleased to announce that full planning has now been granted! Whilst waiting for the permission we have been busy with ecology works. As well as creating the new lakes, we are currently converting the former cricket pavilion into a bat roost so that the bats can be relocated from other buildings on the site that will be demolished. The relocation area for the great crest newts is also now well established and features a new pond and hibernacula ready for the translocation of the newts.

Spotlight on St Leonards Quarter, Exeter

Demand for property in Exeter, the county town of Devon, is currently higher than any other city in the UK. Our latest project, St Leonards Quarter, is a two-phase development of 146 apartments and townhouses in one of Exeter’s most sought-after neighbourhoods.

Spotlight on Old County Hall, Truro

Truro, the county town of Cornwall is one of the UK’s top property ‘hotspots’. Our latest project, Old County Hall is a two-phase development in the city, comprising a Grade II-listed conversion and a contemporary apartment block on an existing car park behind the listed building.

Making it simple

Now you can monitor your investment(s) online via the platform at app.acornpropertyinvest.com.

You will automatically receive a quarterly income if that is your chosen option. Alternatively, you will receive a lump sum on completion of the project, including any share of projected profit.

Returns are not guaranteed, and previous performance is not an indicator of future performance.

Please note that property investments involve risks including loss of capital, illiquidity, default of a borrower and lack of returns. The risks involved will vary by project types, so please make sure you have read and understood the specific risks associated with the investment. Investments made on this website should only be made as part of a diversified investment portfolio. For more details, see the Key Risks within the Information Memorandum. Projections or estimated returns are not a reliable indicator of actual future performance and eventual returns or dividends may be lower than predicted. Information presented on this website is for guidance purposes only and does not constitute financial advice. If you are unsure of the suitability of an investment, please contact your financial adviser for professional advice.

Acorn Property Group is a trading name of RST Group Holdings Limited, incorporated in the UK with company number 10719614. The registered office address is 124 City Road, London, EC1V 2NX