UK Autumn Budget 2024: UK Property Market Changes

Explore the UK Autumn Budget and its impact on property taxes. Discover what these changes mean for property investors and alternative investment options.

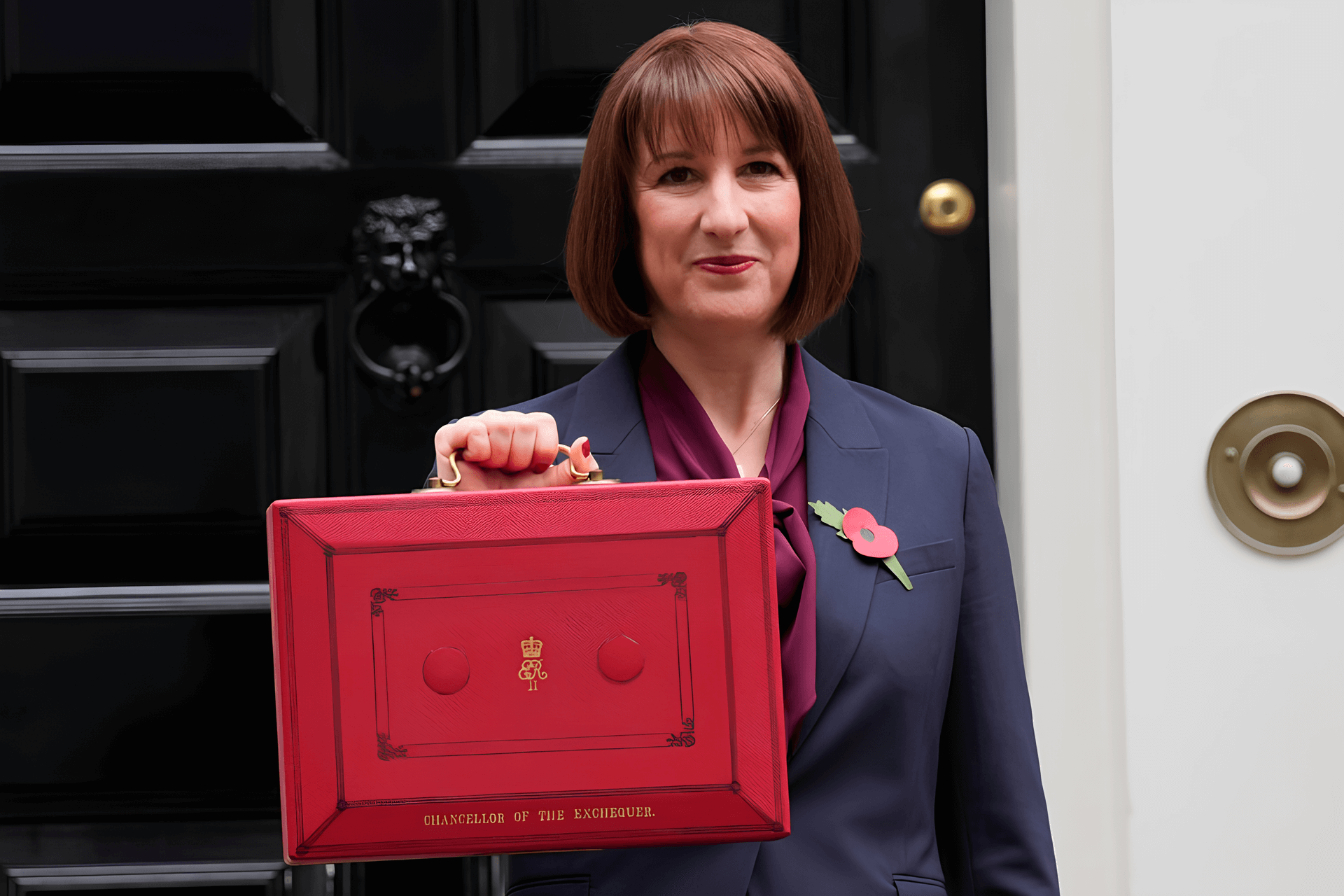

Today’s Autumn 2024 Budget from Rachel Reeves, Labour’s Shadow Chancellor of the Exchequer, has introduced significant changes impacting the property market, specifically targeting buy-to-let and holiday property investors. These changes, which are aimed at creating a more balanced housing market, include tax increases and funding boosts, as well as adjustments to social housing regulations. Here’s what property investors and landlords need to know. Below we dive into a few of these changes.

Increased Stamp Duty Surcharge on Additional Homes

The Chancellor of the Exchequer announced that Stamp Duty on second homes and buy-to-let properties will rise from three to five percent from tomorrow. Additionally, the Budget made no mention of freezing Stamp Duty thresholds, which means these scheduled increases for homebuyers will take effect from the end of March 2025, potentially impacting purchasing decisions and housing affordability in the coming years.

Boost to Affordable Housing Budget

To tackle the wider housing affordability crisis, the budget has allocated an additional £500 million for housebuilding across the UK. This funding increase will raise the Affordable Homes Programme to £3.1 billion, providing essential support and guarantees to boost housing supply. It includes £3 billion specifically aimed at assisting small housebuilders and encouraging more sustainable development practices, ensuring that affordable housing projects can be pursued across regions with the greatest need.

Capital Gains Tax and Residential Property Tax Rate Adjustments

The budget also included an increase to Capital Gains Tax (CGT), a tax applied to profits from selling assets such as a second home or investments, including shares. Specifically, the lower rate of CGT will increase from 10% to 18%, while the higher rate will rise from 20% to 24%. However, the tax rates for residential property transactions will remain at 18% for the lower rate and 24% for the higher rate, providing consistency for property investors but signaling a shift for other asset sellers.

Adapting to a New Property Investment Landscape

The 2024 Autumn Budget presents both challenges and opportunities for property investors. The increased tax burden, from higher stamp duty rates on additional properties to elevated capital gains taxes, signals a move toward rebalancing the housing market and potentially moderating the expansion of the buy-to-let sector. For traditional landlords, these measures could mean re-evaluating the viability of current and future investments.

The Rise of Alternative Property Investment Strategies

The added costs of traditional property investments under the new budget have made alternative investments, like those offered by Acorn Property Invest, increasingly attractive. With a commitment to sustainable and community-oriented development, Acorn Property Invest provides structured property investment options without the operational challenges associated with direct property ownership.

Important Risk Information

YOUR CAPITAL IS AT RISK IF YOU INVEST

Investors should be aware that market conditions can change, and there is no guarantee that this demand will remain high or that investments will yield returns. Investment opportunities available via Acorn Property Invest are exclusively targeted at exempt investors who are experienced, knowledgeable and sophisticated enough to sufficiently understand the risks involved, and who are able to make their own decisions about the suitability of those investment opportunities. All investors should seek independent professional investment and tax advice before deciding to invest. Any historic performance of investment opportunities is NOT a guide or guarantee of future performance and any projections of future performance are not guaranteed. All investment opportunities available via Acorn Property Invest are NOT regulated by the Financial Conduct Authority (FCA) and you will NOT have access to the Financial Services Compensation Scheme (FSCS) and may not have access to the Financial Ombudsman Service (FOS).

Contact Us

Fill out the form below and we will contact you soon.