Savills Market Conditions and Potential Performance Report for Acorn Property Group

Leading property agents, Savills UK recently presented a comprehensive analysis of the current market conditions and potential performance for Acorn Property Group's developments in the South West and South Wales.

Market Conditions and Potential Performance for South West England

Leading property agents, Savills UK recently presented a comprehensive analysis of the current market conditions and potential performance for Acorn Property Group's developments in the South West and South Wales. At Acorn Property Invest, we aim to provide valuable insights into the property market, specifically tailored to Acorn's unique portfolio of properties. This report assesses the demand for Acorn's homes, considering the profile of buyers, quality of stock, and level of competing supply. Let's delve into the key findings and conclusions.

Executive Summary and Key Conclusions

The residential property market in 2023 presents certain challenges due to rising interest rates and increased affordability pressures for potential buyers. However, the impact of these factors will not be uniform across the market. Resilient markets, with lower reliance on debt and affordability pressures, are expected to outperform. Moreover, long-term trends such as the undersupply of new build properties and growing buyer preferences for energy-efficient homes will continue to drive the market.

Savills’ analysis of Acorn Property Group's past performance, current development pipeline, and Experian demographic data indicates that Acorn is well positioned to weather the current market conditions and potentially outperform the wider market. This optimistic outlook is driven by three key factors.

Buyer Types

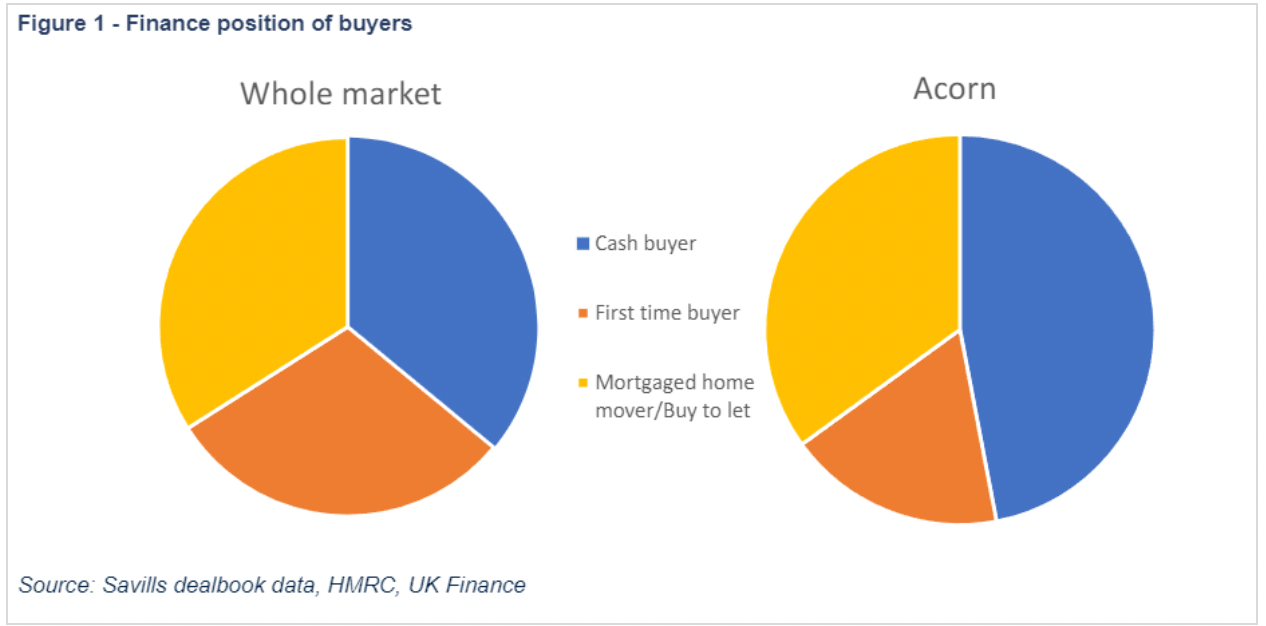

While overall transaction volumes are forecasted to drop by 27% from their pre-pandemic norm, this decline is likely to be weighted toward first-time buyers, who made up 18% of all transactions, and mortgaged buy-to-let landlords. Cash buyers, who accounted for over 40% of all transactions in March and April 2023, are expected to remain robust, with a forecasted decrease of only 4% compared to the pre-pandemic norm, by 2025. Acorn's developments are located in areas that attract more affluent "in movers," who are less exposed to affordability challenges in the housing market as well as downsizers and cash buyers. This buyer profile inspires confidence in Acorn's capability to sustain high sales rates.

Location

Acorn is delivering new homes in markets that have experienced long-term undersupply, leading to significant pent-up demand. Moreover, there is a lack of high-quality new build homes in these markets. Across all Acorn sites analysed, the new build share of market activity was only 7.2%, well below the national average of 10%. This suggests a promising opportunity to accommodate a greater influx of new homes, harnessing the untapped potential within these markets. Notably, areas like Bruton, Chillington, Fairford, and Greet are particularly underserved, making them even more promising prospects for Acorn's development endeavours. By addressing the unmet demand for high-quality new build homes in these markets, Acorn is poised to contribute significantly to the housing sector's growth and cater to the needs of eager home buyers seeking modern, well-designed properties in these areas.

Product Type

Acorn's commitment to incorporating energy efficiency and renewable technology into their homes aligns with growing buyer preferences. Buyers are increasingly placing emphasis on sustainability credentials when making purchasing decisions. Savills' buyer survey found that 68% of respondents considered EPC ratings important, and a significant percentage indicated willingness to pay a premium for homes powered predominantly by renewable sources. Acorn's dedication to sustainability is truly remarkable as it caters to an important and previously overlooked market. Currently, only 13.4% of the existing properties in Acorn's operating areas hold an EPC rating of B or above, presenting a fantastic opportunity for significant positive impact. From summer 2023 onwards, all of Acorn's new-build houses will proudly carry an EPC rating of A or B, exemplifying their commitment to a greener and more environmentally-conscious future.

Price Forecasts and Regional Variation

Savills' forecasts for the national market indicate a slowdown in 2023, with a peak-to-trough fall of 10% in prices across the UK. However, prices are expected to start climbing again in 2024, accompanied by a recovery driven by cuts to the base rate in response to anticipated inflation decrease. Regional and local variations in market performance are expected, with prime markets showing greater resilience due to their lower reliance on debt.

“Acorn’s pipeline sites in South Somerset, Exeter, Tewkesbury and Newport are all in locations to likely benefit from this market outperformance.”

Transactions and Buyer Types

The current uncertain market, coupled with increased debt costs, is expected to result in a decline in transactional activity. However, this decline will predominantly affect buyers dependent on mortgage finance, such as first-time buyers and mortgage buy-to-let landlords. In contrast, home movers and cash buyers are projected to be more robust, with cash buyers gaining a larger share of market activity. Acorn's sales volumes are likely to perform strongly due to their buyer profile, as referenced in the buyer type section of this article.

Supply Dynamics

The demand for homes will also be influenced by supply into the market. Acorn's future pipeline includes sites in local authorities that have experienced significant under delivery of new homes compared to targets.

"New build sales typically account for 10% of all transactions in the housing market. Across all of the Acorn sites we have analysed, new build share of market activity was only 7.2%, suggesting there is additional market capacity to absorb a higher level of new build homes."

Based on Savills’ analysis, Acorn is well positioned to weather the current market conditions and potentially outperform the wider market. The profile of buyers, the undersupply of new homes in Acorn's operating areas, and the incorporation of sustainability features contribute to this positive outlook.

Contact Us

Fill out the form below and we will contact you soon.