How you can benefit from the UK’s booming property market at the click of a button

With the UK's property market booming, now is the perfect time to take advantage of the current trends and invest in property. The great news is that you can now do this at the click of a button, thanks to the amazing advancements of technology.

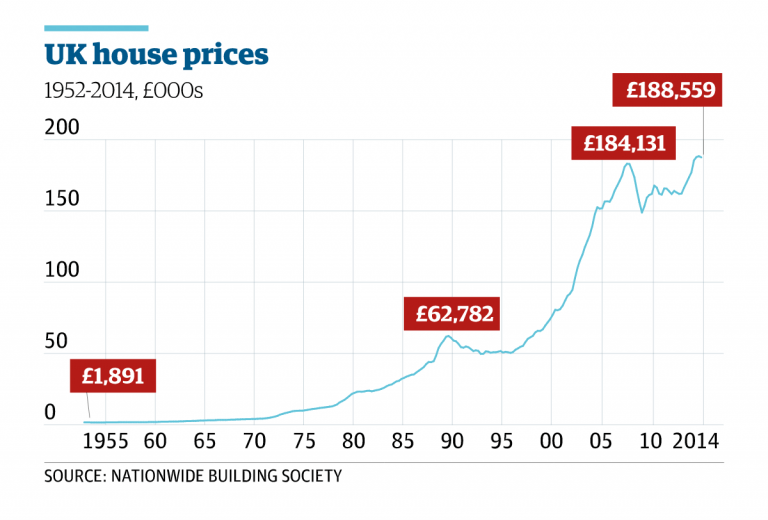

In recent decades, property has proved itself a highly resilient investment. Even during times of market turbulence and global uncertainty, the average price of a house in the UK has continued to rise inexorably, from £1,891 in 1955 (a little over £65,000 in today’s money) to £275,000 in the year to December 2021. Little wonder that property is generally regarded as a sure-fire way to make money - as long as you are prepared to hold on to it for the long term.

The ongoing popularity of property is underpinned by a combination of strong demand and weak supply. Homeownership remains the tenure of choice in the UK, with the 2014 British Social Attitudes survey finding that, while 65% of people in England own their own home (actually a fall from 71% in 2003) given the choice, 86% of people would prefer to do so if they could.

There is a well-documented shortage of housing in the UK, and affordable housing in particular. A House of Commons research brief published in February 2022 estimated that around 340,000 new homes are needed every year in England alone, yet the Government’s target is a modest 300,000. And given that the actual figure for new homes constructed peaked at 243,000 in 2019/20 before falling, mid-pandemic, to just 216,000 in 2020/21, many commentators consider even this target unachievable in the short term.

Another issue is the lack of appropriate housing stock, in terms of quality and geographical spread. In many of the UK’s most economically successful areas there is an acute lack of housing that meets buyers’ requirements. All of these factors contribute to the success of property as an asset class, and this is a trend that looks set to continue.

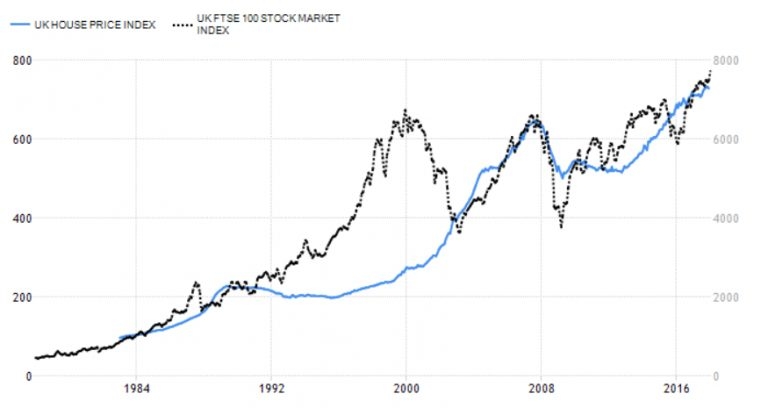

As this chart shows, compared with equities property produces comparable returns over time, and with much lower volatility. Even someone who invested at the height of the market in mid-late 2008 will have seen the value of their asset rebound to the level at which they bought, if not above. In fact, in sought-after locations such as London, property prices rebounded within only two years.

In a low interest-rate environment, and particularly set against a backdrop of inflationary pressures, property compares very favourably over the longer term when compared with investment classes such as savings accounts and bonds.

What are the different ways of investing in property?

Traditionally, investing in property has meant buying the physical asset, either to renovate and ‘flip’, as a long-term investment or as a buy-to-let. But with house prices now an average of seven times local salary, finding the means to do so is increasingly hard. Mortgages currently represent almost 18% of the average net income, and a typical first-time buyer now puts down 110% of their pre-tax annual income as a deposit.

Investing in buy-to-let is even more financially challenging, with higher fees, higher deposits as a percentage of the Loan To Value and generally higher interest rates. And once acquired, making money from a buy-to-let property requires a great deal of time and energy, as well as an ability to bear unforeseen costs.

Renovating a property and then selling it on can be lucrative but is generally time-consuming and requires a large initial outlay - as well as an eye for design. And overspends, delays due to planning issues, market downturns and other factors can significantly impact returns.

Real Estate Investment Trusts (REITs) / Equities

For property investors looking for a less hands-on way to invest, the traditional alternative has either been a REIT or shares in a property developer. A REIT is an investment vehicle that pools investors’ funds to acquire income-producing real estate, such as office buildings, retail space, leisure facilities or hotels. REITs tend to pay high dividends, and investors can automatically reinvest these to grow their investment further.

One of the principal downsides to REITs is that they are highly sensitive to changes in interest rates, as any increase in the cost of borrowing negatively impacts the returns on offer. And since REITs are often focused on a specific sector or property type, such as city-centre office space or shopping centres, they can be at the mercy of wider market trends. In addition, similarly to equities, publicly-traded REITs can see their value go down as well as up; and non-traded REITs can be illiquid and hard to value.

Online property investing

Fortunately, in the last ten years the Internet has created new avenues for property investors and made the process both simple and transparent. Investors can now benefit from the vibrant UK property market by investing online in peer-to-peer (P2P) loans, crowdfunding or directly in development projects.

Why invest in property online?

- Low initial outlay

- Easy to invest, easy to monitor

- Build a portfolio of hand-picked investments

- Diversify into property, choosing a range of investments by sector/type/term/rates in line with short or long-term investment goals

- High rates of return compared with many other asset classes

- Low fees compared with e.g. REITs

- Terms are generally fixed, as are returns (although these are not guaranteed)

- Much shorter investment term than the physical asset

- Invest ethically by choosing housebuilders with a clear commitment to sustainability

- Invest in a tangible asset compared with e.g. bonds or equities

Peer-to-peer (P2P) loans/crowdfunding

As the name would suggest, P2P lending involves loaning money directly to companies or individuals without an intermediary such as a bank. P2P loans are hosted on specialist online investment platforms and are widely used in property acquisition and development, where there is usually a significant initial outlay and bank funding will not cover the full project costs.

Crowdfunding is similar to P2P lending, although it generally involves investors joining together to acquire a stake in a property themselves. While P2P lending and crowdfunding offer a simple way to invest in property, both routes naturally involve an element of risk. Investors therefore need to do thorough diligence prior to investing, to see how much protection is offered by the platform should the investment fail to deliver the promised returns.

Direct investments in property developments

One of the newest, and arguably simplest methods of online investing is to invest directly in a property development. Housebuilders such as Acorn offer fixed-term, fixed-rate investments in the form of shares that are redeemed by the company at the end of the investment term, plus a share of the profits when these have been realised.

Investors can carry out detailed due diligence on the housebuilder and choose which development, or developments to fund. By doing so they can select a housebuilder, such as Acorn, with a proven track record and an achievable development strategy. They can receive regular progress updates from the comfort of their own home, and choose whether to receive quarterly income or capital growth, in the form of a lump sum at the end of the investment term.

Should I invest in property online?

Property is a resilient asset class that should form part of any diversified portfolio, especially at a time when low interest rates and rising inflation are combining to reduce the returns being offered by many other asset classes. There are various ways to invest in property, but by far the simplest is to invest online, where you can choose an option that suits your investment objectives.

If you’d like to find out more about Acorn’s range of investment opportunities offering quarterly income or capital growth, please contact Investor Services on 0203 858 9881 or via email at investor.services@acornpg.org.

YOUR CAPITAL IS AT RISK IF YOU INVEST

Investment opportunities available via Acorn Property Invest are exclusively targeted at exempt investors who are experienced, knowledgeable and sophisticated enough to sufficiently understand the risks involved, and who are able to make their own decisions about suitability of those investment opportunities. All investors should seek an independent professional investment and tax advice before deciding to invest. Any historic performance of investment opportunities is NOT a guide or guarantee for future performance and any projections of future performance are not guaranteed. All investment opportunities available via Acorn Property Invest are NOT regulated by the Financial Conduct Authority (FCA) and you will NOT have access to Financial Services Compensation Scheme (FSCS) and may not have access to the Financial Ombudsman Service (FOS).

Contact Us

Fill out the form below and we will contact you soon.