Beyond Buy-to-Let: Diversifying Your Portfolio with an Alternative Property Investment

Investing in the property development industry in the South West offers a unique opportunity for individuals looking to diversify their investment portfolio. Acorn Property Invest enables investors to enter the vibrant UK property market in a simple and transparent manner. By diversifying beyond traditional buy-to-let properties, investors can enhance their returns and mitigate risk.

Understanding the Property Development Industry

The property development industry is a dynamic one that involves the construction, renovation, and sale of properties. Investing in the property development industry can provide investors with the opportunity to earn a return on their investment through the sale or rental of properties.

At the core of the property development industry is the creation and transformation of physical spaces. Property developers identify promising locations, acquire land or existing structures, and embark on construction or renovation projects. These projects can range from residential developments like apartment complexes and housing estates to commercial ventures such as office buildings, shopping centers, and hotels.

Understanding the Importance of Diversification

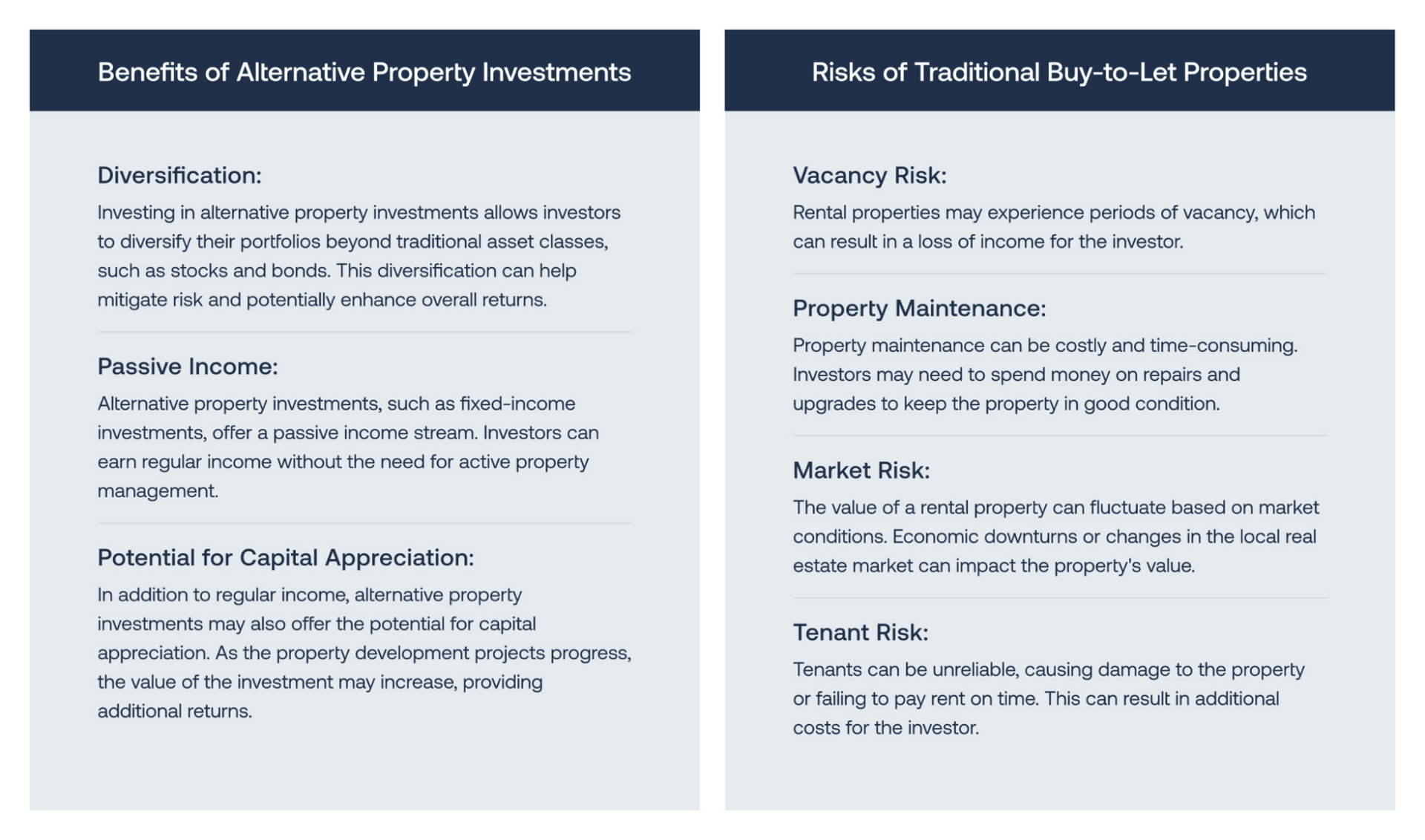

Diversifying an investment portfolio is a widely recognised strategy to lower investment risk. By allocating investments across different asset classes, such as stocks, bonds, and real estate, investors can reduce their exposure to any single investment and potentially enhance their overall returns.

Exploring Alternative Property Investments

Fixed Income Investments:

Acorn Property Invest offers fixed-income investments within the property development industry. These investments provide investors with a predictable and regular income stream, making them an attractive option for those seeking stable returns. Unlike traditional buy-to-let properties, where income is generated through rental payments, fixed-income investments provide a predetermined return on investment, typically through interest payments or profit-sharing agreements.

Diversifying your investment portfolio with alternative property investments, such as fixed-income investments within the property development industry, can provide a stable and consistent income stream. Acorn Property Invest offers a transparent and straightforward way to enter the vibrant UK property market. Investors can enhance their returns and mitigate risk by exploring beyond traditional buy-to-let properties. Contact us to learn more about the benefits of alternative property investments and learn how to diversify your portfolio today.

Contact Us

Fill out the form below and we will contact you soon.