UK Property Market 2025: What Investors Need to Know

After a period of uncertainty and shifting dynamics, the UK property market in 2025 appears to be regaining its footing. House prices continue to climb, buyer demand is rising, and regional hotspots are emerging, presenting both opportunities and considerations for investors aiming to navigate this evolving landscape.

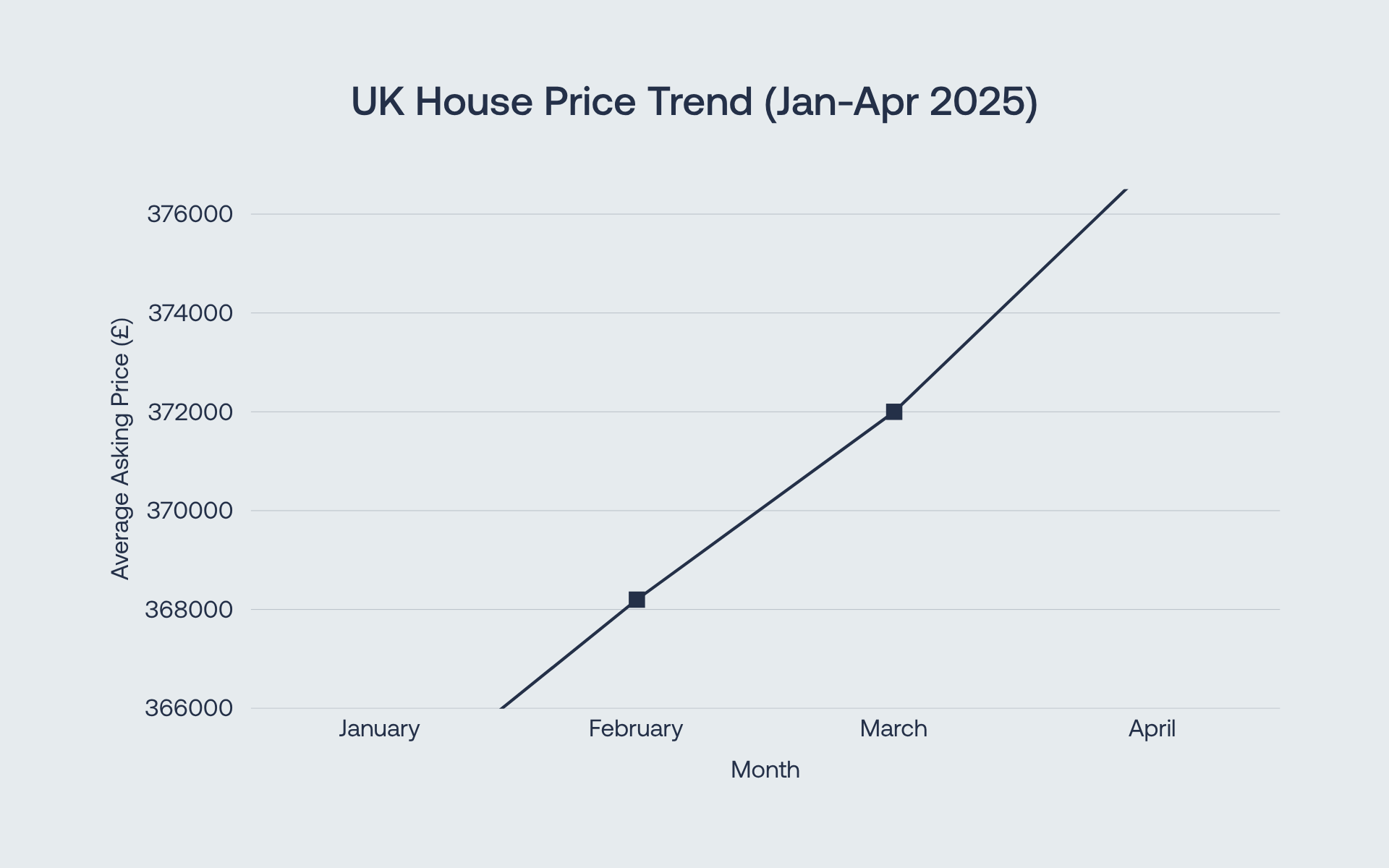

House Prices Surge, Defying Predictions

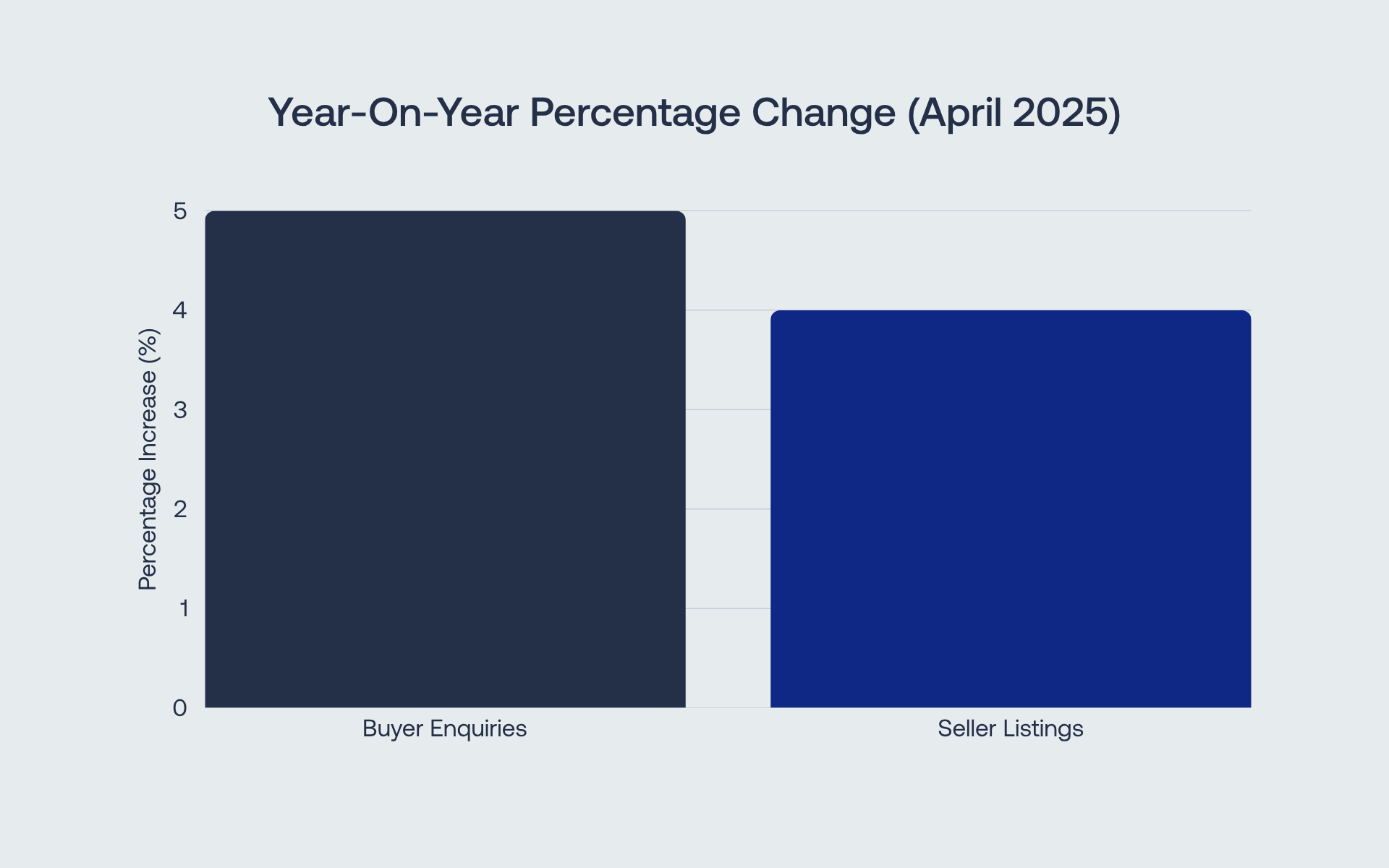

The latest figures from Rightmove show the average UK asking price has reached a new peak of £377,182, reflecting a month-on-month increase of 1.4% and annual growth of 1.3%. This rise, surprising some analysts given the recent stamp duty increase, highlights enduring buyer demand, which remains robust despite economic headwinds. Rightmove’s April 2025 House Price Index further reveals buyer enquiries are up by 5%, matched by a 4% rise in sellers listing properties.

Source: Rightmove’s April 2025 House Price Index rightmove.co.uk

A Post-Pandemic Market Reset

Post-pandemic stability appears to be taking root. Government initiatives aimed at accelerating brownfield regeneration, coupled with planning reforms designed to streamline housing delivery, are beginning to show tangible impacts. Increased supply through targeted urban brownfield development is seen as a significant catalyst for sustained growth.

Interest Rates Offer Stability for Investors

The Bank of England’s decision to maintain a more predictable interest rate environment is welcome news for investors, providing clarity in financing decisions. Stable interest rates have led to increasingly attractive fixed-rate mortgages, making investment planning more straightforward, particularly appealing to those targeting off-plan and new-build properties.

Source: “House prices hit record high in April 2025,” Rightmove, April 2025. rightmove.co.uk

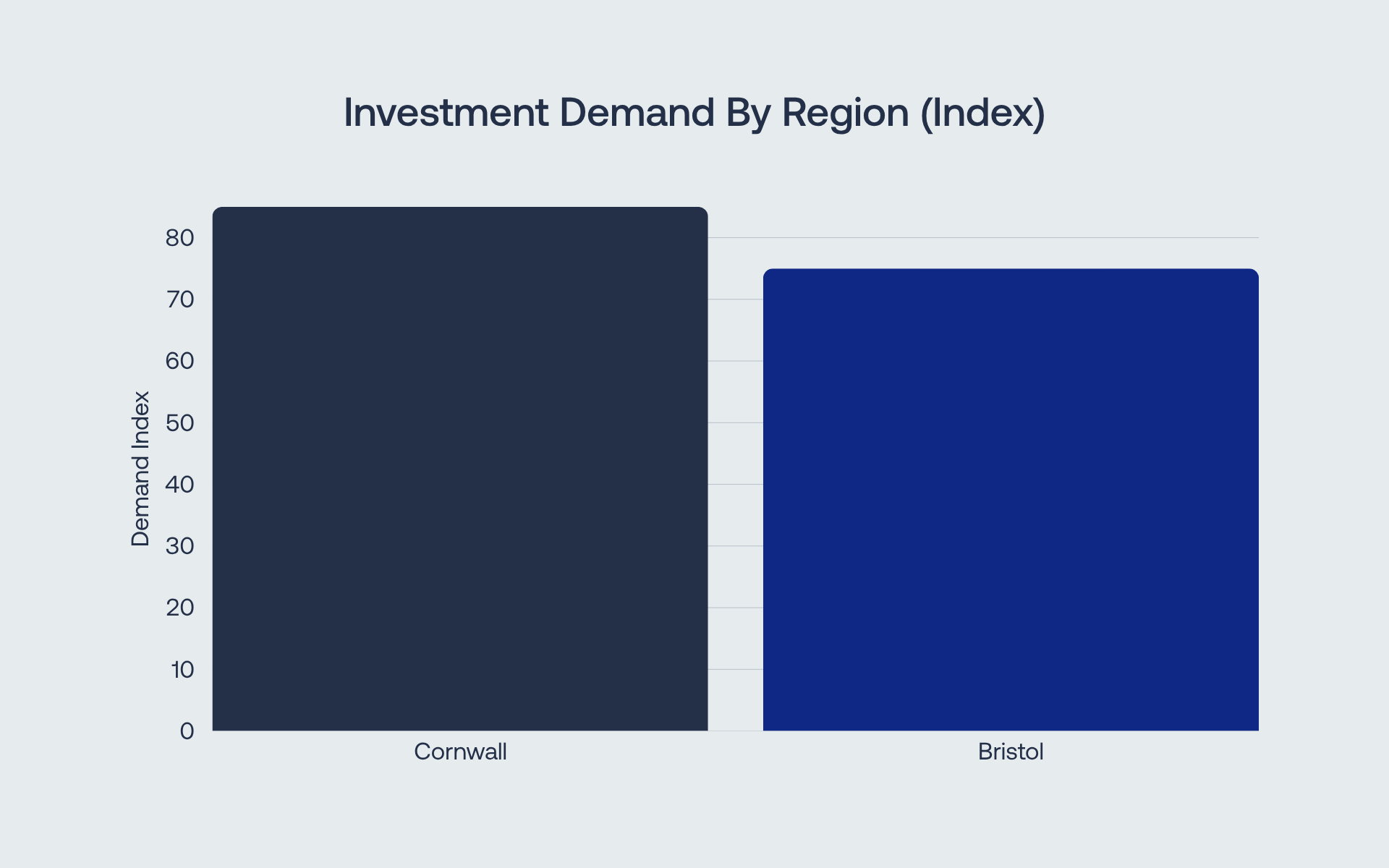

Regional Markets: Cornwall and Bristol in Focus

Regional diversity remains key. Cornwall, with its perennial appeal, continues to attract investment, particularly in coastal hotspots like St Ives, Falmouth, and Padstow. Demand here is driven strongly by holiday home buyers and remote workers, underscoring the importance of choosing locations with intrinsic lifestyle appeal.

Meanwhile, Bristol’s sustained growth is increasingly drawing attention. Boosted by strong fundamentals including a thriving creative and tech economy and excellent transport connections, Bristol is becoming a magnet for property developers and investors seeking both rental returns and long-term capital growth. Acorn Property Group has recognised these opportunities early, investing strategically in communities primed for sustained development.

Source: “The UK’s next property hotspots revealed,” WhatHouse, March 2025. whathouse.com

Sustainability and Innovation Set the Pace

Sustainability credentials have rapidly moved from desirable to essential. EPC ratings and smart home technologies now influence investment decisions significantly, as buyers increasingly prioritise eco-friendly and future-proofed homes.

What This Means for Property Investors

Investors considering opportunities in the current market should carefully evaluate location dynamics, sustainability credentials, and economic conditions. Acorn Property Group is actively responding to these trends by developing strategic and sustainable projects across the UK, particularly in emerging hotspots such as Cornwall and Bristol. For those interested in property development, Acorn Property Invest provides opportunities to participate directly in property development projects, offering potential avenues for investors seeking exposure to property development markets.

Conclusion

As 2025 unfolds, the UK property market presents clear opportunities for informed investors. Acorn Property Group and Acorn Property Invest offer strategic guidance and practical investment pathways tailored for the current landscape, underpinned by a deep understanding of regional dynamics, sustainable development, and market innovation.

Contact Us

Fill out the form below and we will contact you soon.